Tesla stock (TSLA) has been on an absolute monstrous tear higher over the last two months gaining over 115% in that time period alone. To make matters even better, the stock also hit limits on an 83 RSI recently (1/8/2021) on 50 million shares intraday. This equates to approximately $41.6 Billion dollars changing hands in Tesla stock in one day (1/11, $832/share x 50m shares traded) with no sign of slowing down.

Or is there more to the story?

Last years low on Tesla split adjusted was $70.10. (3/20) And the stock is as of this writing trading at $836.00. That equates to a 1094% gain in less than a year. Perhaps some stocks are capable of realizing these types of gains in such a short period of time without consequence, however I am writing this article to share two main points:

- 1000%+ returns on a stock with a market cap of over $1B in a year are unsustainable.

- The amount of money that changes hands in a stock when it’s at all time highs matters, and is indicative of future price movements.

Since the US government printed so many trillions of dollars in 2020, approximately $9T (t for trillion) in circulation and around 20% of money in circulation was printed in one year, something that is unprecedented outside of war time conditions, it is not at all implausible nor illogical for that money to funnel into stock, especially ones that are already in an uptrend like Tesla.

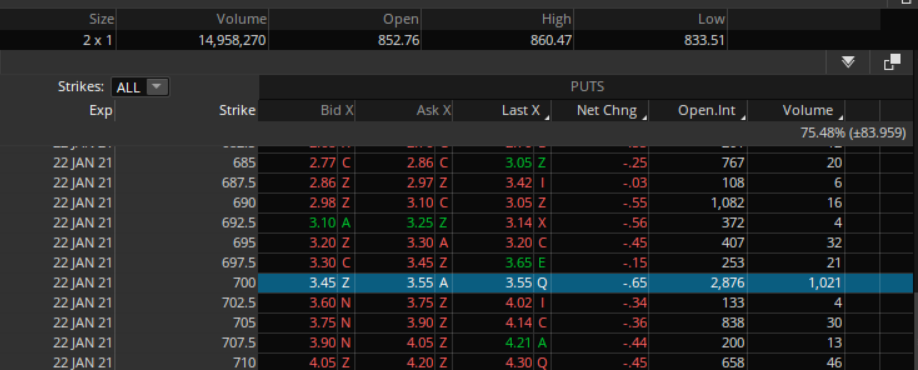

However, there is always a point of exhaustion to which every stock that gains 1000% or more in a year comes to. The timing of this point of exhaustion is key as is the context since a mere 16% retrace in a stock like Tesla right now would yield a 10x on the January 22 700 strike price pits, if the stock goes to $700 by next Friday.